Not known Factual Statements About Wealth Management

Wiki Article

Get This Report on Wealth Management

Table of ContentsGetting The Wealth Management To WorkWhat Does Wealth Management Mean?The Greatest Guide To Wealth ManagementThe Basic Principles Of Wealth Management The Greatest Guide To Wealth Management

You intend to guarantee that your household might survive economically without drawing from retired life financial savings must something take place to you. As you age, your investment accounts need to come to be extra conservative - wealth management. While time is running out to conserve for individuals at this stage of retirement preparation, there are a few advantages.And also it's never also late to establish up and add to a 401( k) or an IRA. One benefit of this retirement preparation stage is catch-up payments.

This is also the time to check into long-term care insurance, which will certainly help cover the expenses of a nursing home or residence care should you need it in your advanced years. If you do not properly prepare for health-related costs, particularly unanticipated ones, they can decimate your savings. The Social Protection Administration (SSA) provides an online calculator.

Things about Wealth Management

It takes right into account your complete financial picture. How does that fit right into your retired life strategy?

There may additionally be changes boiling down the pipe in Congress pertaining to estate taxes, as the estate tax amount is scheduled to go down to $5 million in 2026. When you get to old age as well click here for more info as begin taking distributions, taxes end up being a big problem. A lot of your retired life accounts are taxed as average revenue tax obligation.

5 Simple Techniques For Wealth Management

Age includes boosted medical costs, and you will certainly have to navigate the often-complicated Medicare system. Lots of people feel that basic Medicare does not provide adequate insurance coverage, so they seek to a Medicare Advantage or Medigap policy to supplement it. There's additionally life insurance coverage and long-lasting treatment insurance coverage to take into consideration. An additional sort of plan released by an insurer is an annuity.

You placed cash on down payment with an insurer that later on pays you an established regular monthly amount. There are various choices with annuities as well as lots of factors to consider when determining if an annuity is ideal for you. Retired life preparation isn't tough. It's as simple as reserving some money every monthevery little matters.

You might additionally desire to take into consideration talking with an expert, such as a monetary planner or investment broker that navigate to these guys can guide you in the right direction. The earlier you begin, the much better. That's due to the fact that your investments expand gradually by earning passion. And you'll gain interest on that interest. Retired life preparation allows you to sock away sufficient money to preserve the very same lifestyle you presently have.

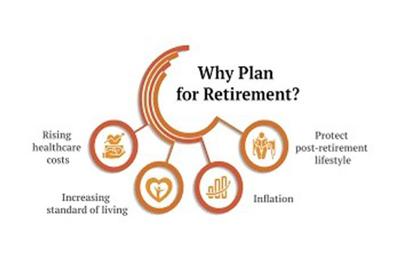

That's where retired life preparation comes right into play. As well as it does not matter at which factor you are in your life.

About Wealth Management

We have actually developed a detailed overview that can aid you prepare your retirement. Lots of financial investment choices can assist you conserve for retired life. We recognize that growing your cash securely is crucial.When spending your money, make certain that you conserve effectively for any kind of unexpected economic demands. Life insurance policy can guard your enjoyed ones with a safety monetary safety and security in your lack.

When getting ready for the future, attempt to select different kinds of investment choices that put your money in differing click over here now property classes, sectors, and markets. By doing this, if you endure a loss in one investment or if one choice does not perform per your expectations, you can count on the others.

As an example, if you wish to work out in a brand-new city, your monthly expenditures can be greater, depending on the city. Similarly, if you such as to take a trip, you may spend more on travel expenditures in retired life than somebody that prefers going to house. Your desires can aid you pick an ideal strategy that can create sufficient returns.

A Biased View of Wealth Management

These can differ depending on the plan you select. Retired life strategies typically enable you to select the premiums you wish to pay towards your plan, as per your demands. A higher premium might bring about a higher income throughout your retired life. The vesting age is the age at which you can begin getting your pension or earnings from the plan.Report this wiki page